Accounting policy

Defined contribution plans

The pension cost related to the Group’s defined contribution plans is equal to the annual contribution made

to the employee’s individual pension accounts in the accounting period. Annual contributions correspond to

an agreed percentage of the employee’s salary in accordance with local pension arrangements. In Norway, the

rate is five per cent of annual basic salary, limited upwards to twelve times the social security basic amount.

In addition, 18.1 per cent contribution is made for annual basic salary between 7.1-12 times the social security

basic amount. The pension contributions are expensed when incurred. The return on the pension funds will

affect the size of the employees’ pension, and the risk of returns lies with the employees.

Defined benefit plans

In the defined benefit plans, the Group companies are responsible for paying an agreed pension to the

employee based on his or her final pay. Defined benefit plans are valued at the present value of accrued future

pension obligations at the end of the reporting period. Pension plan assets are valued at their fair value. The

capitalised net liability is the sum of the accrued pension liability minus the fair value of the associated pension

fund asset.

Actuarial gains and losses are recognised in other comprehensive income. Introduction of new or changes

to existing defined benefit plans that will lead to changes in pension liabilities are recognised in the income

statement as they occur. Gains or losses linked to changes or terminations of pension plans are also recognised

in the income statement when they arise.

Other severance schemes

Other severance schemes comprise mainly of obligations related to pension schemes for employees in the

Norwegian companies with an annual basic salary exceeding 12 times the basic amount (G). In addition, minor

statutory obligations to employees in a few other countries are also included. Obligations related to other

severance schemes are recognised as non-current liabilities.

Estimate and judgement

Defined benefit plans are calculated based on a set of selected financial and actuarial assumptions. Changes

in parameters such as discount rates, future wage adjustment, etc. could have a substantial impact on the

estimated pension liability. Similarly, changes in selected assumptions for the return on pension assets could

affect the amount of the pension assets. The Group will not be materially affected by a reasonable expected

change in key assumptions.

All assumptions are reviewed at each reporting date.

5.3 REMUNERATIONS

Jotun Group

Back to contents >

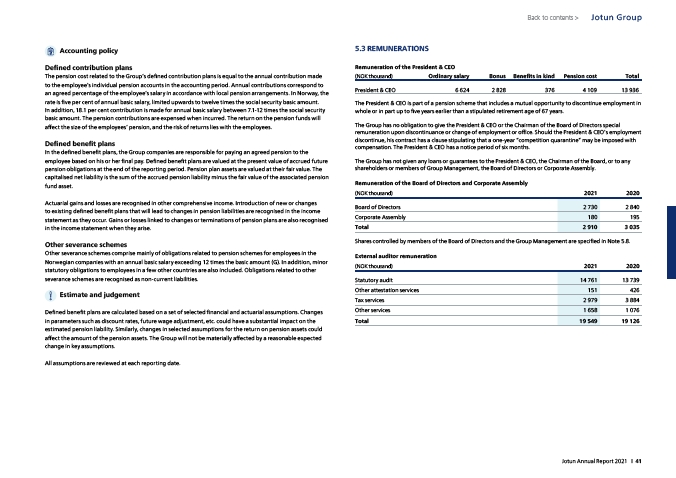

Remuneration of the President & CEO

(NOK thousand) Ordinary salary Bonus Benefits in kind Pension cost Total

President & CEO 6 624 2 828 376 4 109 13 936

The President & CEO is part of a pension scheme that includes a mutual opportunity to discontinue employment in

whole or in part up to five years earlier than a stipulated retirement age of 67 years.

The Group has no obligation to give the President & CEO or the Chairman of the Board of Directors special

remuneration upon discontinuance or change of employment or office. Should the President & CEO’s employment

discontinue, his contract has a clause stipulating that a one-year “competition quarantine” may be imposed with

compensation. The President & CEO has a notice period of six months.

The Group has not given any loans or guarantees to the President & CEO, the Chairman of the Board, or to any

shareholders or members of Group Management, the Board of Directors or Corporate Assembly.

Remuneration of the Board of Directors and Corporate Assembly

(NOK thousand) 2021 2020

Board of Directors 2 730 2 840

Corporate Assembly 180 195

Total 2 910 3 035

Shares controlled by members of the Board of Directors and the Group Management are specified in Note 5.8.

External auditor remuneration

(NOK thousand) 2021 2020

Statutory audit 14 761 13 739

Other attestation services 151 426

Tax services 2 979 3 884

Other services 1 658 1 076

Total 19 549 19 126

Jotun Annual Report 2021 I 41